In India, Non-compliance isn’t just a legal issue. It can have serious financial and reputational consequences.

If companies fail to follow statutory rules, they may face hefty penalties, lawsuits, or even the cancellation of their business licenses.

According to the Ministry of Labour and Employment, companies failing to comply with statutory rules may face fines ranging from ₹1,000 to ₹10 lakhs, depending on the severity of the violation.

Risks of Non-Compliance:

- Penal Action & Financial Losses: Non-compliance Company can attract heavy fines, interest on delayed payments, and even criminal liability for directors or responsible officers.

- Reputation & Business Integrity: It can tarnish an organization’s brand image, erode stakeholder trust, and undermine business integrity in the market.

- Customer & Investor Loyalty Impact: They raise red flags for customers, investors, and global partners.

This blog is designed to guide and assist HR and payroll teams in handling day-to-day tasks such as PF, ESI, and TDS deductions. It will also help compliance officers, CFOs, CHROs, and senior management in developing and implementing effective HR strategies.

What is statutory compliance?

- Statutory compliance is the act of following laws, rules, regulations and internal policies governing the workforce. It adheres to State Acts and Central Acts of the Government.

- Payroll compliance is the process of adhering to laws, regulations, and statutory obligations related to employee salaries, PF, taxes, and other deductions to avoid legal fines, penalties, and ensure reputational damage.

- As a responsible corporate citizen, people should adhere to the local State Acts and Central Acts mandated by the government.

Business leaders willing to understand and implement HR compliance in India must understand its types.

Automate compliance with ZingHR’s

Zero-Touch Payroll and avoid penalties while saving time.

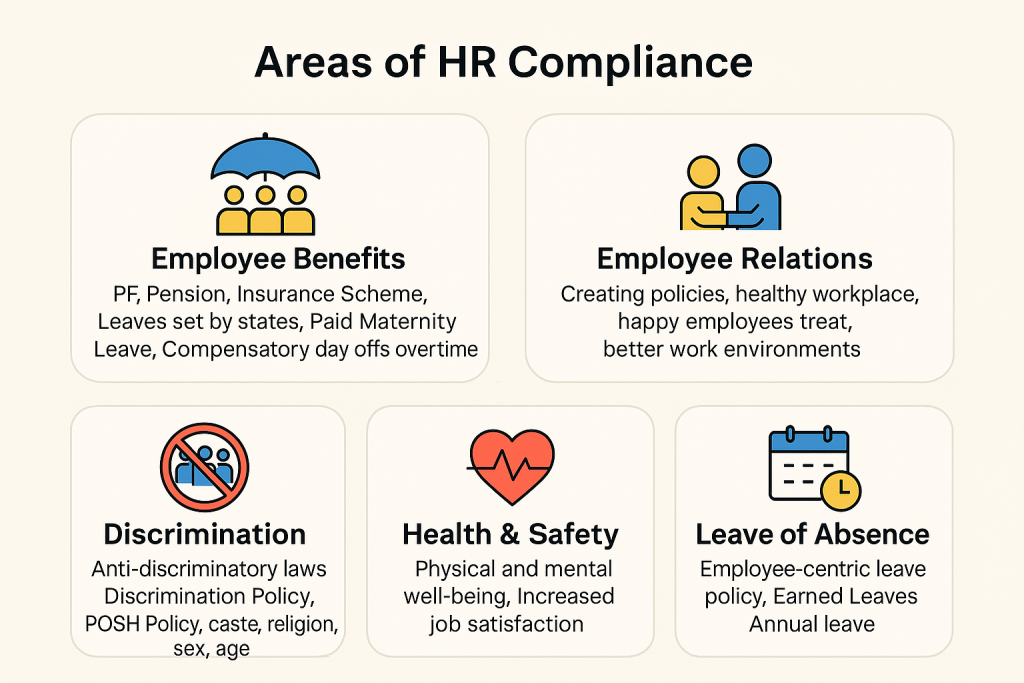

Types of HR compliance

1. Statutory Compliance

This refers to adherence to laws enacted by the central, state, and local governments, such as labor laws, tax regulations, and wage laws. It ensures that organizations meet the minimum legal standards required for employee treatment and business operations. These laws provide benefits like provident fund, gratuity, minimum wages, and safe working conditions.

2. Regulatory Compliance

Regulatory compliance involves following the rules and guidelines set by industry-specific regulatory bodies. The regulations imposed in India by the Securities and Exchange Board of India (SEBI), the Reserve Bank of India (RBI), the Food Safety and Standards Authority of India (FSSAI), and the Telecom Regulatory Authority of India (TRAI). This type of compliance includes maintaining licenses, submitting mandatory reports, and aligning with sectoral standards.

3. Contractual Compliance

This compliance ensures that the organization meets the obligations outlined in contracts with employees, vendors, or clients. It helps avoid legal disputes and maintain business credibility.

4. Union Law Compliance

Union law compliance relates to managing relationships with labor unions, including collective bargaining agreements, grievance handling, and fair labor practices. It ensures respectful and lawful interaction between employers and unionized employees.

5. Internal Compliance

Internal compliance focuses on adherence to company-specific internal policies, codes of conduct, and ethical standards. It helps reinforce a culture of accountability and consistency within the organization.

6. Workplace Safety & Health Compliance

This ensures that employers provide a safe and healthy working environment, following laws like PoSH or other national safety regulations.

Acts are Covered Under Statutory Compliance

The following 10 Acts are Covered Under Statutory Compliance. Let’s understand what each of them entails.

The Shops and Establishments Act (State-specific)

- The Shops and Establishments Act regulates working conditions, working hours, opening and closing times, payment of wages, leave, holidays, and other service conditions for employees in shops, commercial establishments, hotels, restaurants, and other similar entities.

- Per this Act, a ‘shop’ is any premise (online or offline) where goods are sold to customers or services are rendered to customers. On the other hand, an ‘establishment’ is a factory-like premise where goods are manufactured and prepared to be sold.

- This Act is state-specific, meaning it may have different clauses for shops and establishments in different states. It protects the rights of employees of outlining rules related to wages, rest intervals, leaves, etc.

The Factories (Amendment) Act, 1987

- The Factories Act focuses on ensuring the health, safety, and welfare of workers employed in factories, setting standards for working hours, cleanliness, ventilation, lighting, and accident prevention.

- The objective of this Act is to ensure factories provide a physically safe workplace for employees. It is applicable to any factory that uses electricity and employs 10 or more workers during any part of the manufacturing process. The Act requires factory owners to maintain a safe premise for operations and also details penalties for failing to do so.

The Payment of Gratuity Act, 1972

The Payment of Gratuity Act mandates the payment of gratuity – a lump sum amount – to employees by their employers as a token of gratitude for services rendered. The Act covers employees working in factories, shops, offices, establishments, railways, oilfields, and mines.

Gratuity is a kind of retirement benefit provided to employees. The amount is typically available to employees upon completion of at least five years of continuous service in the same company and is paid post-retirement, resignation, death, or disablement. The Act allows for this benefit for full-time as well contractual workers.

The Employees’ Provident Funds & Miscellaneous Provisions Act, 1952

- The Employees’ Provident Fund & Miscellaneous Provisions Act requires companies to establish a mandatory provident fund, pension fund, and deposit-linked insurance fund for employees. Generally, both employer and employee contribute to these funds to provide retirement and old-age benefits to industrial and other eligible employees.

- The Act details three employee benefit schemes: Employees’ Provident Fund Scheme (EPF), Employees’ Pension Scheme (EPS), and Employees’ Deposit-linked Insurance Scheme (EDLI). All funds deposited in these schemes earn an interest—which is paid to the employee—as notified by the Central Government. The Central Board of Trustees (CBT) and the Employees’ Provident Fund Organization (EPFO) administer this Act’s legislation.

The Employees’ State Insurance Act, 1948

- The Employees’ State Insurance Act provides for medical, sickness, maternity, disability, and dependent benefits to employees and their families in certain industries and establishments, funded by contributions from both employers and employees.

- This Act was the first major legislation on social security for Indian workers. The primary objective of the ESI Act is to provide social security to employees and their families by shielding them from the financial burdens caused by health-related problems and workplace injuries resulting in loss of wages or earning capacity.

The Minimum Wages Act, 1948

- The Minimum Wages Act empowers the central and state governments to fix and revise minimum wages for different kinds of employment, ensuring that workers receive a basic standard of living and preventing exploitation.

- The Act is applicable to both skilled and unskilled laborers. The primary goal was to protect workers in vulnerable sectors with low bargaining power from being underpaid and, thus, reduce the gap between low- and high-wage earners.

The Payment of Bonus Act, 1965

- The Payment of Bonus Act governs the payment of a bonus to employees in certain establishments based on their profits or productivity, typically mandating a minimum and capping a maximum percentage of an employee’s salary or wage as a bonus.

- The Act is crucial for ensuring fair compensation and fostering positive employer-employee relations by allowing employees to share in company prosperity. Companies are allowed to select any percentage of employee salary for bonus payment, ranging from 8.33% to 20%, subject to available surplus.

The Payment of Wages Act, 1936

- The Payment of Wages Act regulates the timely payment of wages to certain classes of workers and prevents unauthorized deductions from their wages, ensuring transparency and fairness in wage disbursements.

- The Act sets out rules for wage periods and the time of payment, preventing undue delays. It also explicitly defines the types of deductions that can be made, preventing employers from imposing arbitrary cuts in wages. Further, the Act details a mechanism for employees to file claims and seek resolution in cases of delayed payment or unauthorized deductions.

The Maternity Benefit Act, 1961

- The Maternity Benefit Act provides maternity leave and other benefits to women employees during pregnancy and childbirth, including paid leave, medical bonus, and protection from dismissal.

- The Act primarily aims to promote gender equality in the Indian workplace. It ensures the well-being of mothers and their newborns. The Act enables mothers to recover and care for their children without fear of losing their jobs or facing financial hardship.

The Sexual Harassment of Women at Workplace Act, 2013 (PoSH)

- The PoSH Act mandates the prevention of sexual harassment against women at the workplace and the creation of a safe workplace. It seeks to protect women’s dignity and rights at work and establish a system for addressing complaints.

- Sexual harassment under the Act includes unwelcome conduct of a sexual nature, such as physical advances, requests for sexual favors, suggestive remarks, and other unwelcome sexual conduct. Situations linked to sexual harassment like promises or threats related to employment, creating a hostile work environment, or humiliating treatment affecting health or safety may also be considered. The Act requires employers to establish Internal Complaints Committees (ICCs) for investigating complaints and finding a resolution.

Statutory Compliance Checklist for HR and Employees

The following checklist ensures adherence to the legal requirements of HR compliance in India. Although in-detail supervision is required to thoroughly comply with statutory and other regulations, the checklist comes in handy while saving time and ensuring accuracy.

Employee Benefits Checklist

Employees’ Provident Fund (EPF)

- Applies to organizations with 20 or more employees.

- Covers employees earning up to INR 15,000 per month, although those earning more can also apply.

- Both the employer and the employee contribute 12% of the employee’s salary (basic + dearness allowance) to the fund.

- Due date is the 15th of the following month (for example, contribution for July 2025 must be made by 15th August 2025).

- Must be deposited with the Employees’ Provident Fund Organisation (EPFO).

Employees’ State Insurance (ESI)

- Applies to organizations with 10 or more employees.

- Covers employees earning up to INR 21,000 per month (INR 25,000 for persons with disabilities).

- The employer’s contribution is 3.25% of the employee’s salary, while the employee contributes 0.75%.

- Due date is the 15th of the following month.

- Must be deposited with the Employees’ State Insurance Corporation (ESIC).

Gratuity

- Applies to organizations with 10 or more employees.

- Covers employees who have completed at least five years of continuous service in the same company.

- Payable upon retirement, resignation, superannuation, death, or disablement.

- Maximum limit is INR 20 lakhs.

- Formula: (15 x Last drawn salary x Number of years of service) / 26.

Bonus

- Applies to organizations with 20 or more employees.

- Covers employees earning up to INR 21,000 per month.

- Minimum bonus payable is 8.33% of the employee’s salary, while maximum is 20%.

- Formula: If the salary is less than INR 7,000, then Bonus = (Basic salary + DA) * Bonus percentage. If the salary exceeds INR 7,000, then Bonus = 7,000 * Bonus percentage.

TDS (Tax Deduction at Source)

- Employers are responsible for deducting income tax at source from employees’ salaries based on applicable tax slabs.

- Must provide Form 16 (TDS certificate) to employees annually by specific deadlines.

- Requires timely deposit of deducted tax with the Income Tax Department and filing of TDS returns.

Workplace Safety Checklist

The Factories Act, 1948

- Applies to factories employing 10 or more workers with power, or 20 or more without power.

- Mandates provisions for workers’ health (cleanliness, ventilation, drinking water), safety (machinery guarding, fire safety), and welfare (creches, canteens).

- Regulates working hours, leave, and employment of women and young citizens.

- Requires registration and approval of factories with the Chief Inspector of Factories.

The Contract Labour (Regulation and Abolition) Act, 1970

- Applies to organizations or contractors employing 20 or more contract laborers.

- Mandates registration of establishments and licensing of contractors.

- Requires employers to adequately provide for worker welfare, wages, and social security.

Employee Relations Checklist

Maternity Benefit Act, 1961

- Applies to organizations employing 10 or more persons.

- Provides for paid maternity leave to women employees—26 weeks for the first two children and 12 weeks for others.

- 6 weeks of leave is provided in case of miscarriage or medical termination of pregnancy.

- Full salary must be paid to women during the leave period.

- Women adopting a child under three months of age are entitled to 12 weeks of paid leave.

- Mandates a medical bonus and protection against dismissal during pregnancy and maternity leave.

Sexual Harassment of Women at Workplace (Prevention, Prohibition, and Redressal) Act, 2013 (PoSH Act)

- Mandates every employer with 10 or more employees to constitute an Internal Complaints Committee (ICC).

- Requires employers to formulate and widely publicize an anti-sexual harassment policy.

- Employers are responsible for creating awareness and a safe workplace.

- Ensures a mechanism for redressal of sexual harassment complaints, including inquiry and recommendations.

Industrial Employment (Standing Orders) Act, 1946

- Applies to industrial establishments employing 100 or more workmen (some states have lower thresholds).

- Requires employers to formally define and certify conditions of employment (for example, working hours, holidays, termination, and disciplinary action) known as Standing Orders.

- Aims to minimize arbitrary actions by employers and provide certainty regarding terms of employment.

Equal Remuneration Act, 1976

- Prohibits discrimination in remuneration (wages) between men and women for the same work or work of a similar nature.

- Forbids discrimination on the ground of gender in recruitment processes (unless gender-specific roles are legally permitted).

- Requires employers to maintain registers showing the remuneration paid to employees.

Explore ZingHR’s Comprehensive HRMS to

Simplify Payroll Compliance Today

Why HR Compliance Is Crucial for Business Leaders?

Compliance means following rules. If you follow the rules that apply to your business, you can stay in business for a long time. Business leaders ensuring HR compliance in India can benefit from the following:

1. Helps Avoid Legal Penalties

Non-compliance brings reputational damage, financial losses, and legal liabilities. It can lead to strict legal action, sometimes even shutting down business operations indefinitely.

Therefore, staying updated and ensuring statutory compliance in HR is always recommended. It can help you avoid the legal charges, penalties, and time involved in proceedings.

2. Builds Brand Loyalty

A brand that does right by the law and doesn’t often find itself in sensational ethical or legal wrongdoings is a brand loved by all. People prefer such brands to others competing for the same market. A consistent effort to maintain compliance at all levels and even highlight it at times builds a loyal, growing customer base.

3. High Employee Retention

Complying with fair employment and workplace laws automatically results in happier, more satisfied employees. Businesses that prioritize compliance ensure employees get paid and treated fairly, access to health and leave benefits, and a safe, open workplace to grow. In return, employees like to stay with such legally correct and reputable companies for longer.

Thus, legally compliant companies can build a good employer brand that will assist in their future endeavors. In essence, legal compliance supports a business’s sustained growth.

What Are the Best Practices to Stay Compliant?

1. Regular Audits and Self-Assessments

- Ticking items off your HR compliance checklist is a big win, but sustained success comes in the form of regular evaluation and modification. Self-assessments may enable you to reflect and identify gaps and improvement areas.

- Meanwhile, regular audits by separate internal or external teams provide an unbiased, third-party perspective on gaps you may have missed. Both are great ways to improve continuously.

2 Staying updated with labor law changes

- Governments often update laws to accommodate changing workplace needs. By staying up-to-date with all the latest changes, you can avoid unintentional non-compliance.

- Read up on news regularly, subscribe to trusted HR newsletters, join HR groups and networks, and stay active online to catch hold of legal compliance updates in your industry.

3. Compliance training for HR and employees

- A good way to enforce statutory compliance in India in your company is to train your HR executives as well as non-HR employees. This training should provide information on laws, how to comply, the importance of compliance, and the risks of non-compliance.

- Usually, a one-off training session won’t work in the long term, which is why you should organize refresher sessions, too. This will also enable you to incorporate labor law changes into the training material.

4. Partnering with legal experts

Instead of dedicating an internal HR team to legal compliance, you can partner with a third-party expert. Hiring an external individual or agency on a need basis may help you cut personnel costs and time. Such collaboration will provide your company with expert insights based on years of experience, technological support, smart decision-making, and helpful recommendations.

5. Maintaining transparency in HR policies

Unclear communication leads to confusion and mistakes. When drafting HR policies, request the input of legal staff or external experts to contribute. Make the policies as detailed, clear, and transparent as possible—so much that employees don’t feel the need to get something clarified. Explain processes, steps, the redressal mechanism, the support team’s contact, etc., in detail.

These best practices for HR compliance in India are applicable to all organizations—small or large, startup or corporate, professional or creative. Following them is a fail-safe way of staying on the right side of the law while expanding and prospering your business.

Automate compliance with ZingHR’s

Zero-Touch Payroll and avoid penalties while saving time.

The Role of Technology in Ensuring HR Compliance in India

HR compliance is an ever-evolving concept subject to economic, financial, and political changes at the company, state, or national level. A strong understanding and dedication are what make statutory compliance for HR achievable. Technology helps, too. With modern software setting their footing in organizations worldwide, HR processes are being automated, reducing the risk of common errors that occur in manual compliance procedures.

Here are some ways HR software streamlines legal compliance:

- Automated payroll means on-time, accurate payment to employees based on their employment contract.

- Modern human resource management systems (HRMS) provide a secure platform to store, manage, and access confidential employee data, adhering to the Digital Personal Data Protection Act (DPDP Act), 2023.

- Performance management software ensures fair release of bonuses and increments based on employee performance.

- Records maintained in HR systems aid in transparent compliance audits and support real-time modifications.

- Some human resource management systems (HRMS) also provide automated, error-free report drafting and submission features.

Simplify Compliance Tracking with ZingHR

ZingHR is an all-in-one HCM software suite ready to automate and ease your company’s HR processes.

From payroll and benefits to digital data management, our software implements several checks to ensure your organization complies with all applicable laws.

Learn about compliance updates from AI-based personalized LMS, automatically classify workers as full-time or contractual, and manage your remote workforce lawfully—do it all with ZingHR. Book a demo today!