On This Page

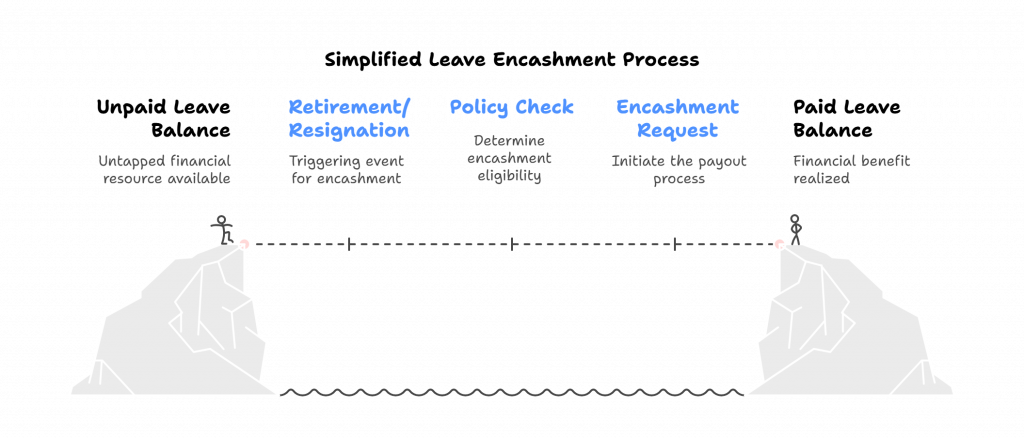

We spend most of our working lives focused on promotions, deadlines, and paychecks. Rarely do we think about all the earned leaves that are piling up in the background. We use some of them for vacations or emergencies, but what happens to the ones that remain unused by the time you retire or resign? That’s where leave encashment comes in.

In simple words, leave encashment is like a hidden savings account. Your employer pays you cash for the unused leaves accumulated over the years. It’s like a welcome bonus that you get when you’re closing one chapter and beginning the next chapter of your life. But, there’s a catch: depending on who you work for, this payout could be fully exempt, partially exempt, or fully taxable under Indian Income Tax Laws.

And that’s exactly why understanding leave encashment exemption is very important.

The rules are not the same for everyone – government employees enjoy full exemption, while private-sector employees must calculate their exemption carefully under Section 10(10AA) of the Income Tax Act.

What is Leave Encashment Exemption?

Leave encashment is the amount an employee gets for unused leave accumulated over time. Instead of taking those leaves, the employee chooses to encash them. It means they get paid for the days they didn’t take leave.

By now, you know that leave encashment is the payment you receive for your unused earned leaves when you leave your job or in some cases, while you’re still working.

Leave encashment exemption refers to how much of your leave encashment is exempted i.e. not taxable.

Leave encashment exemption depends on the timing of your leave encashment.

- During service: Fully taxable, no exemption.

- On resignation or retirement: Eligible for exemption under Section 10(10AA).

- Government employees: The entire amount is exempt on retirement, i.e. no tax.

- Private employees: Partially exempt up to specified limits.

Understanding these distinctions is very important to avoid paying unnecessary taxes or receiving government notices later on.

Budget Updates & Court Decisions

Before we dive into definitions, let’s look at what’s changed recently:

1. Latest Budget Update

In the 2023 Union Budget, the government raised the leave encashment tax exemption limit for non-government employees from ₹3 lakh to ₹25 lakh. This was considered a major change, as the older limit had remained unchanged since 2002.

(Remember, this doesn’t apply if you encash leaves during the service. It only applies on termination of service, resignation, or retirement.)

2. Important Court Decisions

Over the years, many cases and the Central Board of Direct Taxes (CBDT) circulars have clarified how leave encashment is taxed. Let’s take a look at them.

- CIT vs. R.J. Shahney (1992): The Supreme Court held that leave encashment during service is fully taxable as salary income.

- CIT vs. M.P. State Electricity Board (1992): Leave encashment on retirement for government employees is fully exempt.

- CBDT Circular No. 8/2007: Reiterated that leave encashment exemption under Section 10(10AA) is only applicable on retirement/superannuation.

In short, the law clearly distinguishes between leave encashed while working (fully taxable) and leave encashed at the end of employment (eligible for exemption).

Smart Leave Management for Hassle-Free Encashment

Track, Manage, and Automate Leave Balances

Leave Encashment Exemption Under the Income Tax Law

Now that you understand the basic distinctions of leave encashment exemption, let’s take a deeper look at how Section 10(10AA) treats different employees.

Government Employees

As stated earlier, if you’re a Central or State Government employee, any leave encashment you receive at the end of your employment is 100% tax-free.

Private Sector Employees

If you’re a private sector employee, your leave encashment exemption is allowed up to the least of the following four amounts.

Actual leave encashment received

- 10 months’ average salary.

- Cash equivalent of leave balance (Up to 30 days per completed year of service).

- ₹25 lakh.

Any amount you receive over the least of the above amounts is fully taxable as salary income.

Leave Encashment Taxability

Now let’s clearly understand when your leave encashment is taxable and when it’s exempt:

Leave encashment during service

Leave encashment during service is fully taxable i.e. if you encash your leave while you’re still employed, the entire amount is added to your salary and taxed based on the slab. For example, if you receive ₹1 lakh as leave encashment during service, the entire amount is fully taxable i.e. no exemption.

Leave encashment on retirement/resignation/termination

Leave encashment on retirement/resignation/termination is eligible for exemption under Section 10(10AA). Here, you can claim exemption as per the rules. For government employees, leave encashment is fully exempt. For private sector employees, leave encashment is limited up to the least of the aforementioned 4 amounts.

Leave Encashment Calculation Formula

This is the part that most people find confusing, so let’s break this down step-by-step, making it easier for you to understand and help others understand how Leave encashment is calculated.

Formula for private sector employees

Exemption = The least of the following four amounts

- Actual leave encashment received.

- 10 months’ average salary.

- Cash equivalent of leave balance (Up to 30 days per completed year of service).

- ₹25 lakh.

What is “Average salary”?

The formula for calculating leave encashment is: Average salary = Average of basic salary + Dearness Allowance (DA)(If it’s a part of your retirement benefits) + Commission (As a percentage of turnover) for the last 10 months immediately preceding retirement.

Note: Other allowances such as HRA, conveyance, etc., are not included.

Leave Encashment Exemption Example

Mr. Yogesh Sharma, a private sector employee retiring on 31 March 2025 after 20 years of service. Over the past 20 years, Mr. Yogesh has accumulated 300 days of unused leave. His monthly basic salary plus dearness allowance was ₹1 lakh, and he received ₹18 lakh as leave encashment when he retired. Now, to calculate how much is exempt, we take a look at the four amounts.

- Actual leave encashment received = ₹18 lakh.

- 10 months’ average salary i.e. ₹1 lakh X 10 months = ₹10 lakh.

- Cash equivalent of leave balance which is up to 30 days per annum. So, for 20 years that’s up to 600 days, but since Mr. Yogesh only has 300 days of unused leaves, we take that amount. This equals to 10 months’ salary i.e. ₹10 lakh, Here’s the calculation: (300 days divided by 30 X ₹1 lakh) = 10 X ₹1 lakh = ₹10 lakh.

- The maximum exemption limit = ₹25 lakh.

So the least amount of the four above is ₹10 lakh. That means out of the ₹18 lakh Yogesh received as leave encashment, only ₹10 lakh is exempted, which means ₹8 lakh would be the taxable amount.

Exemption Limit & Conditions

Maximum Exemption Limit

₹25 lakh (Effective from FY 2023-24)

Factors Affecting Exemption Eligibility

- Type of employer (Government Vs. Private Sector).

- Completed years of service.

- Unavailed leave balance.

- Salary components.

- Whether leave encashment is received at the time of retirement, resignation, or during employment.

- Any prior exemptions claimed (If you’ve previously claimed exemption from any of your previous employment, the limit of ₹25 lakh is cumulative).

Leave encashment in new tax regime

Yes, leave encashment exemption is available under both the old and new tax regimes. Unlike any other deductions, such as 80C, this exemption is not forfeited if you choose the new regime. So, no matter which regime you choose, you can still claim this exemption.

Smart Leave Management for Hassle-Free Encashment

Track, Manage, and Automate Leave Balances

How to Claim Leave Encashment Exemption?

Now that we know what leave encashment exemption is, how to find out your eligibility and exemption amount. Let’s take a look at the leave encashment claim process.

Steps to Claim Leave Encashment Exemption in Your ITR

- Get your Form 16 from your employer.

- Check “Salary Income” details, the leave encashment amount should be reported separately.

- In your Income Tax Return (ITR), go to the “Salary” section.

- Report the full leave encashment received.

- Claim exemption under Section 10(10AA) by entering the exempt portion.

- The taxable portion gets automatically included in your gross salary.

- Verify and e-file your return.

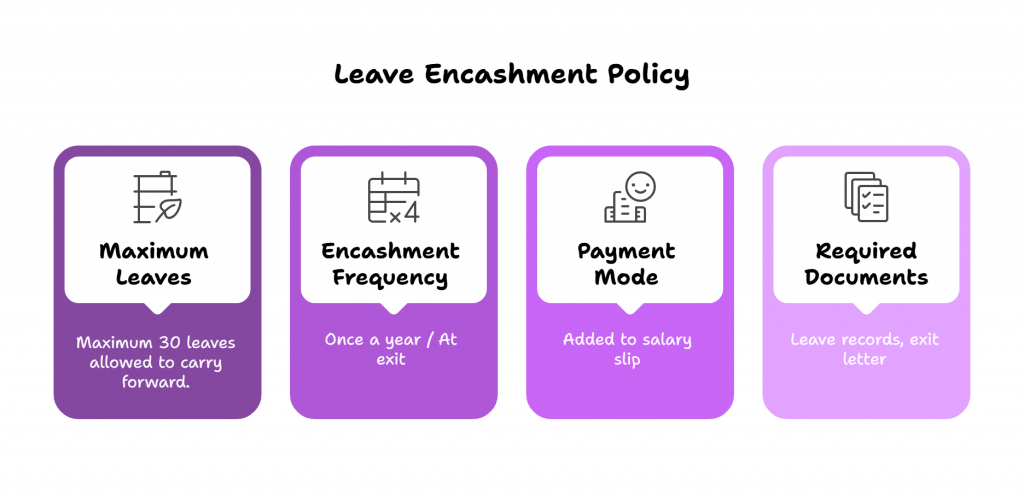

Required Documents

- Form 16 or Salary Certificate showing leave encashment.

- Leave Balance Certificate (From HR).

- Computation sheet (Some companies issue this).

- Bank statement showing the credit.

- Employment proof (Appointment letter or ID proof if needed).

You don’t need to attach these documents to your ITR but it’s good to have them handy.

Also Read: Mandatory 20 HR Policies in India

Wrap Up

Knowing about leave encashment exemption can help you save lakhs of rupees in taxes, especially with the recent increase in the exemption limit from ₹3 lakh to ₹25 lakh.

Here’s a quick recap of the important points you should take away from this blog.

- Government employees: Fully exempt on retirement.

- Private employees: Exempt up to ₹25 lakh, subject to calculations.

- Encashment during service/employment: Fully taxable.

- Old Vs. New regime: Exemption is allowed in both regimes.

- Remember to declare it correctly in your ITR.

We know that all these rules and numbers can feel like a lot. Tax stuff always sounds complicated at first, but once you understand it, it’s really simple and very helpful in life. Leave encashment is just about getting paid for the earned leave you didn’t use during your employment. And it helps you make sure that you don’t end up paying more tax than you need to.

You spend years showing up, putting in the effort, and saving those earned leaves year on year. It’s only fair that when you finally get that money, there should be no confusion about how much of it is yours and how much of it will be deducted in the form of tax.

Whether you’re retiring, starting a new job, or just planning your future, knowing how leave encashment works can save you from last-minute surprises. And now that you’ve already read this blog, you already have a good idea of what to check and what to expect.

At the end of the day, you’ve earned this money with your time and efforts. You deserve to make the most of it.

FAQ

1. What happens to unused leaves?

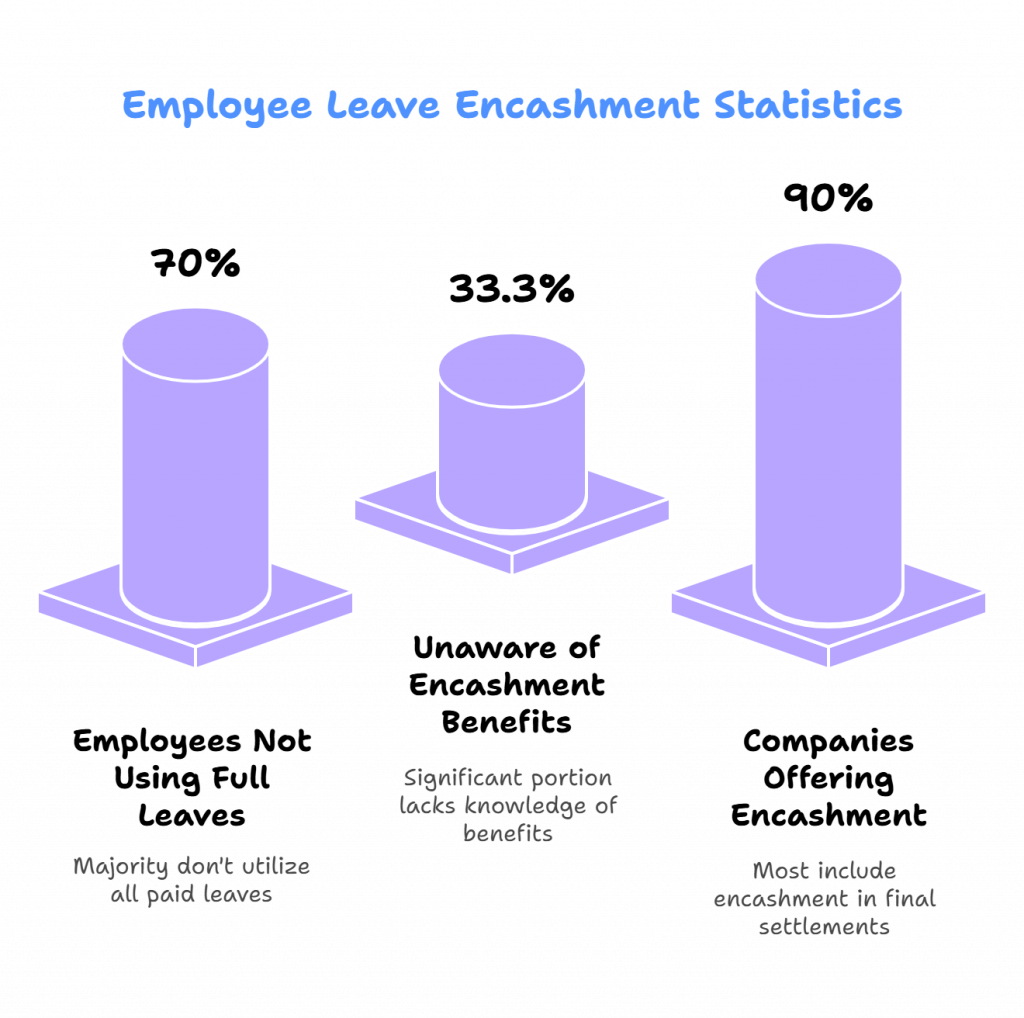

Unused paid leaves are either carried forward to the next year or encashed as per the company’s leave policy. Typically, employees can carry forward up to 30 days of earned leave to the next year, and some organization allow 45 to 60 days as per their company policy.

If leaves are not carried forward or used within the stipulated time, they may lapse. In the event of retirement, resignation, or annually (if permitted), these leaves may be redeemed for monetary compensation.

2. What are the rules for 10-day leave encashment?

Some companies allow 10 days of leave encashment annually or at the end of a specified period based on earned or privileged leave balances. This benefit usually available once a year and is subject to company policy, which may define how many days can be encashed and whether it applies during service or only at exit.

3. Can a company deny leave encashment?

No, leave encashment cannot be denied if it is part of the employee’s earned benefits. As per legal precedents, even employees terminated for misconduct are entitled to encash earned leave that remains unused. However, the rules may vary as per company policy and applicable labor laws.

4. How many leaves can I encash?

The number of leaves you can encash depends on your company’s leave policy. Usually, companies allow encashment of up to 30 to 60 days of accumulated earned or privileged leave. Government employees may be eligible for encashment of up to 300 days at retirement. The limit varies as per the company and employee category.

Smart Leave Management for Hassle-Free Encashment

Track, Manage, and Automate Leave Balances